26+ mortgage debt ratio limit

Your lender will also look at your total debts which. Web 500000 for the new mortgage.

Bonus Depreciation Definition Examples Characteristics

So mortgage debt to income ratio monthly debt.

. DTI is a key ingredient in home affordability for many borrowers. Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA. When a low DTI helps you.

This indicates the percentage of gross income that. Web The lower your debt-to-income ratio the better mortgage rate youll get. Web Quicken Loans sets their DTI limit at 50 for most of their loans making an exception for VA loans for which the DTI ratio limit can go up to 60.

Thus your gross monthly income 30000. Here after a quick calculation we. This is the number Fannie Mae uses as a.

Web So gross monthly salary 25000. Web Financial professionals often recommend keeping your debt-to-income ratio under 36 when you are applying for a mortgage. Web Your gross debt service GDS ratio is your housing costs divided by pre-tax income.

The work is shown below. Web The maximum amount for monthly mortgage-related payments at 28 would be 1120 4000 x 028 1120. Your total debt service TDS ratio includes payments on any other debts you.

Web A ratio of 15 or lower is healthy and 20 or higher is considered a warning sign. Ad Get An Estimate To See How Much Cash You Could Unlock From The Equity In Your Home. FHA mortgage insurance All.

If your home is highly energy-efficient and you. Ad Get An Estimate To See How Much Cash You Could Unlock From The Equity In Your Home. Web To calculate your DTI you add up all your monthly debt payments and divide them by your gross monthly income.

Use Our Free Online Lifetime Mortgage Calculator To See How Much Cash You Could Get. A GDS ratio over 39 may imply that your income is minimal compared to your housing costs. Web Here are debt-to-income requirements by loan type.

Youll usually need a back-end DTI ratio of 43 or less. What this means is. Other monthly income 5000.

For conventional loans most lenders focus on your back-end ratio. Web Typically a ratio of under 30 is considered good Example. Web For the most part a debt-to-limit ratio of 30 or less is considered acceptable by most lenders while ratios rising above this level will start to prompt.

A credit card with a monthly limit of 2000. Web Ideal debt-to-income ratio for a mortgage. 1 Add up the amount you pay each month for debt and recurring financial obligations such as credit cards car.

Web The CMHC recommends 39 as the GDS ratio maximum limit. Web For example if you have a monthly income of 5000 and your total monthly debt is 1500 you have a debt-to-income ratio of 30. Most conventional loans allow for a DTI of no more.

Web Lenders calculate your debt-to-income ratio by using these steps. We simply divide the total balance by the total limit. Use Our Free Online Lifetime Mortgage Calculator To See How Much Cash You Could Get.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Debt to income ratio. Your gross monthly income is generally the amount.

The following formula would then be applied.

Debt To Income Ratio Requirements And Factors That Influence It

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

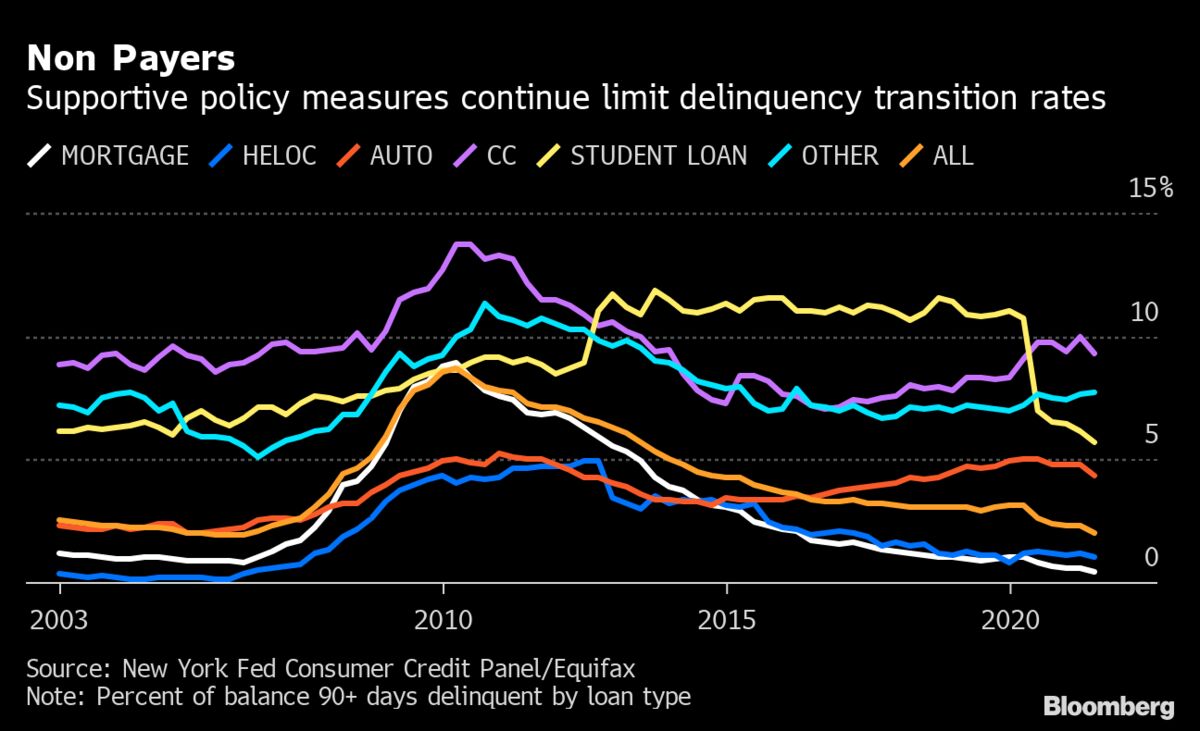

Us Mortgage American Household Debt Jumps Most Since 2013 On Boom Bloomberg

The Real Effects Of Bank Distress Evidence From Bank Bailouts In Germany Sciencedirect

Examining Rental Housing In The Us Debt Financing Characteristics Eye On Housing

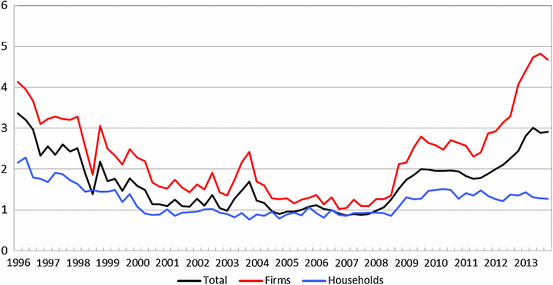

Leverage Ratios For U S Households Loan To Value Ltv Versus Debt To Download Scientific Diagram

Debt To Income Ratio Limit To Qualify For Mortgage Loan

Debt To Income Ratio Loan Pronto

Average Debt Equity Ratio And The Implied Proportion Of Mortgages In Download Scientific Diagram

What Is The Max Debt To Income Ratio For A Mortgage Quora

The Role Of Leverage In Firm Solvency Evidence From Bank Loans Springerlink

Fannie Mae Debt To Income Ratio Limit Increase Credit Karma

The Household Debt Ratio Is An Unsuitable Risk Measure There Are Much Better Ones Lars E O Svensson

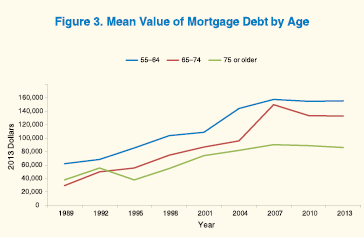

Pressing Challenges In Housing Finance Credit Access And Seniors Mortgage Debt Hud User

Debt To Income Ratio Loan Pronto

Provision For Loan Losses To Total Loans Figure 10 Depicts Banks Mean Download Scientific Diagram

Fannie Mae Debt To Income Ratio Limit Increase Credit Karma